How to trade support and resistance lines on Forex? Many traders are interested in this and similar issues. Trading strategy based on the break of support and resistance levels is effective method on both quiet and dynamic markets. This makes it quite popular among Forex market traders focused on a balanced, calculated tactic.

Before we begin to talk about this trading strategy itself, let’s clarify some terms used there. Levels of support and resistance are essential elements of virtually every strategy for trading in the Forex market, and a major element of technical analysis. The movement of currencies (both during periods of trend and flat movement) always has significant price levels, which are usually formed on the previously reached maximum or minimum movements in the relevant time period.

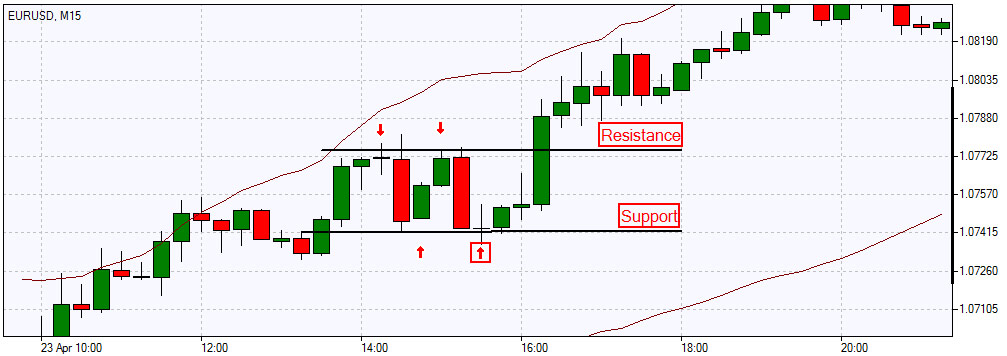

The levels, which are higher than the current exchange rates are called resistance levels, and the levels, which are below the current exchange rates are called support levels. The more currency tested these levels and punched them, the more valuable they are. In case of breakdown of one of these levels currency begins to move to the next level. If the breakdown of this level did not take place or has taken place a false breakout, the price pulls back in the opposite direction, from resistance to support.

Knowing the characteristics of the movement of currencies after the breakdown of trading resistance and support levels and using the criterion of a true breakdown to confirm the breakout, the trader can open transaction, moving together with the movement from one level of resistance or support to another level.

At the flat movements, levels of support and resistance are horizontal, while at the clear trend movement, support / resistance levels are tilted in the direction of the trend.

When trading resistance and support strategy it is advisable to consider the support and resistance levels not of just one but at least two currency pairs, so-called allies (for example, GBPUSD and EURUSD), since the breakdown of the level of support or resistance in the same currency pair, which is not supported by the same movement of its “allie”, is likely to mean a false breakout of the first pair.

Support and resistance levels trading strategy we use to trade on the intraday trend. Each trading session (no matter Asian, European or American) begins and ends mostly with flat. Therefore, prior to active market movement, set horizontal lines on 5 and 15-minute charts of each pair of currencies and their “allies” on the peaks of fractals and zigzags (2-3 repetitive maximum and minimum values of the price bars in the flat).

These lines will be approximately denoting support and resistance levels of each currency pair. Simultaneous break of these levels up of all currency pairs and “allies”, will indicate the direction of currency movements on the current trading session.

However, this is only true in the case of a true breakout levels, ie, breaking the resistance level, the pair should fall back, and then again to strive toward breakdown, overcoming achieved during the initial breakdown maximum or minimum, and move on in the direction of the breakdown, turning the punched the level of resistance into the new level of support.

Thus, the currency pair is moving into a new motion of price, making the transition from level to level. If the price fails to overcome the local maximum / minimum and return back within the previous price range, then the flat continues.

The exit of price from the flat and the beginning of active motion usually lead to the formation of a session trend. In this case, after checking the direction of the session trend, Forex trader, who follows support and resistance levels trading strategy, opens the first transaction, immediately after the price overcame the local maximum / minimum level.

The second and subsequent transactions are opened from each correction (retracement) again in the direction of the session trend. For example, in the upward session trend each time of price’s rollback down, open the deal to Buy on 5- or 15-minute charts. And thus open transactions for each currency pair of so-called "allies" currency pairs.

We proceed similarly with a downtrend. In each roll back of currency price from the downtrend movement, Forex trader should open the deal to Sell. After breaking through one resistance level, a currency, as a rule, goes to the next resistance level.